[vc_row][vc_column][button size=”medium_rd_bt” url=”https://i2e.org/?na=view&id=27″]Return to Newsletter[/button][/vc_column][/vc_row][vc_row][vc_column width=”1/6″][/vc_column][vc_column width=”2/3″][vc_column_text]With more than $90 million of investment capital currently under management, i2E has been a primary source of concept, seed stage, start-up and early growth investment capital for Oklahoma’s emerging small businesses for two decades.

Our rigorous investment process has a reputation for producing companies that are well positioned for success in the marketplace. [/vc_column_text][vc_column_text]

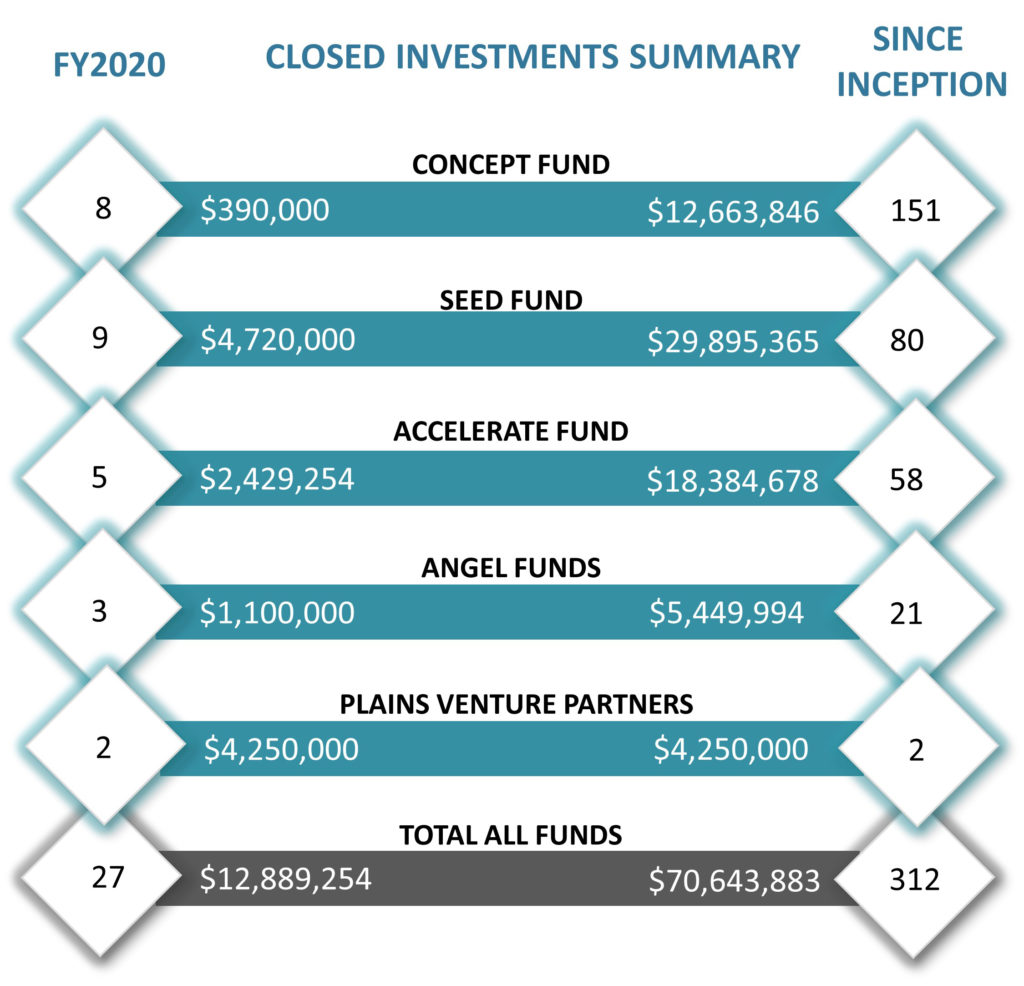

FY2020 CLOSED INVESTMENTS totaling nearly $13 million

[/vc_column_text][/vc_column][vc_column width=”1/6″][/vc_column][/vc_row][vc_row][vc_column width=”1/3″][vc_column_text]

Aevus Precision Diagnostics, Oklahoma City

TBFP- $52,000

Aevus is building an AI powered prescription guidance platform (PrecisionRx)

for treating Type 2 Diabetes.

www.aevus.ai

[/vc_column_text][vc_column_text]![]()

BlyncSync Technologies, LLC , Oklahoma City

TBFP – $50,000

BlyncSync offers a proprietary safety software platform designed to address the increasing problem of fatigue related accidents in the trucking industry.

www.blyncsync.com[/vc_column_text][vc_column_text]![]()

Biolytx Pharmaceuticals, Oklahoma City

Seed Fund II – $170,000

Biolytx is developing a class of novel antibiotic peptides for use in treatments of ophthalmic wound care and serious hospital-acquired infections.

www.biolytx.com[/vc_column_text][vc_column_text]

Clear River Enviro, Edmond

Seed Fund II – $375,000

Clear River Enviro developed a proprietary hospital and surgery-based technology used to destroy unused DEA Controlled Substances (opioids) and EPA regulated pharmaceuticals.

www.rxdestruct.com[/vc_column_text][vc_column_text]![]()

Dex-Pump, LLC, Oklahoma City

TBFP – $100,000

DEX-Pump has developed a patent-pending down-hole pumping system for late in life horizontal wells that facilitates maximum economic recovery.[/vc_column_text][vc_column_text]

Grant Holster, LLC, Tulsa

TBFP – $35,000

Grant Holster is a cloud-based software platform that integrates project management with CRM, providing a best-practices grant management process.

www.grantholster.com

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_column_text]![]()

Datebox, dba Happily, Inc., Oklahoma City

Seed Fund III – $275,000

Datebox is a monthly subscription service that provides a novel date night activity and related conversation topics for people in committed relationships.

www.thehappily.co[/vc_column_text][vc_column_text]![]()

Linear Health Sciences, LLC, Norman

Accelerate, Angel Fund 2, Plains Venture Partners – $4,000,000

Linear Health Sciences is seeking FDA regulatory approval for a new break away technology for IV lines and catheter tubes.

www.linearsciences.com[/vc_column_text][vc_column_text]

MaxQ, Stillwater

Seed Fund II – $250,000

MaxQ is revolutionizing the shipping of temperature‐sensitive biologics with advanced breakthroughs in thermal insulation sciences.

www.packmaxq.com[/vc_column_text][vc_column_text]

Monscierge, Oklahoma City

Accelerate – $ 504,254

Monscierge is an international interactive software company that connects hotels and their guests through both in-room solutions and guest experience solutions.

www.whiteboardcrm.com[/vc_column_text][vc_column_text]![]()

MS Pen Technologies, Inc., Tulsa

Seed Fund III – $500,000

The MasSpec Pen System is composed of a handheld and biocompatible pen-like device connected to a mass spectrometer that rapidly identifies the molecular profile of tissues during surgery.[/vc_column_text][vc_column_text]

Paldara, Inc., Broken Arrow

TBFP – $28,000

Paldara is an early stage biotech company focused on developing a time-release hydrogel solution containing antimicrobial material to address the problem of Catheter Associated Urinary Tract Infections.[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_column_text]

PrivacyBrain, Oklahoma City

TBFP – $65,000

PrivacyBrain is a cyber security platform that removes sensitive employee information from the web.

www.privacybrain.com

[/vc_column_text][vc_column_text]

Progentec, Oklahoma City

Seed Fund III, Angel Fund II, Plains Venture Partners – $2,750,000

Progentec has developed a Lupus test to help physicians to diagnose lupus patients much earlier than symptoms appear, monitor disease activity, and predict flare-ups.

www.progentec.com

[/vc_column_text][vc_column_text]

Send-A-Ride, Oklahoma City

Seed Fund II – $750,000

SendaRide provides nonemergency medical transportation for the health care industry that is customized to each patient’s needs and provided through the Send-A-Ride’s own network of drivers.

www.sendaride.com[/vc_column_text][vc_column_text]

Ten-Nine Technologies, LLC, Tulsa

Seed Fund III, Angel Fund 2, Accelerate –

$2,500,000

Ten-Nine Technologies makes new materials for longer-lasting and more powerful batteries.

www.ten-ninetech.com[/vc_column_text][vc_column_text]

Virtuoso, LLC, Tulsa

TBFP – $60,000

Virtuoso is an embedded systems design workflow and content platform that allows custom embedded application hardware to be effortlessly virtualized.

www.virtuoso-software.com[/vc_column_text][vc_column_text]![]()

WhiteBoard, Edmond

Seed Fund III – $250,000

Whiteboard Mortgage CRM provides a platform for high‐margin, low‐frequency sales personnel to create better relationships, and increase referrals by making it easy to stay in touch with contacts, clients and partners.

www.whiteboardcrm.com[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/6″][/vc_column][vc_column width=”2/3″][vc_column_text]

Here is a summary of our closed investments

for FY2020 and since inception.

[/vc_column_text][vc_column_text]

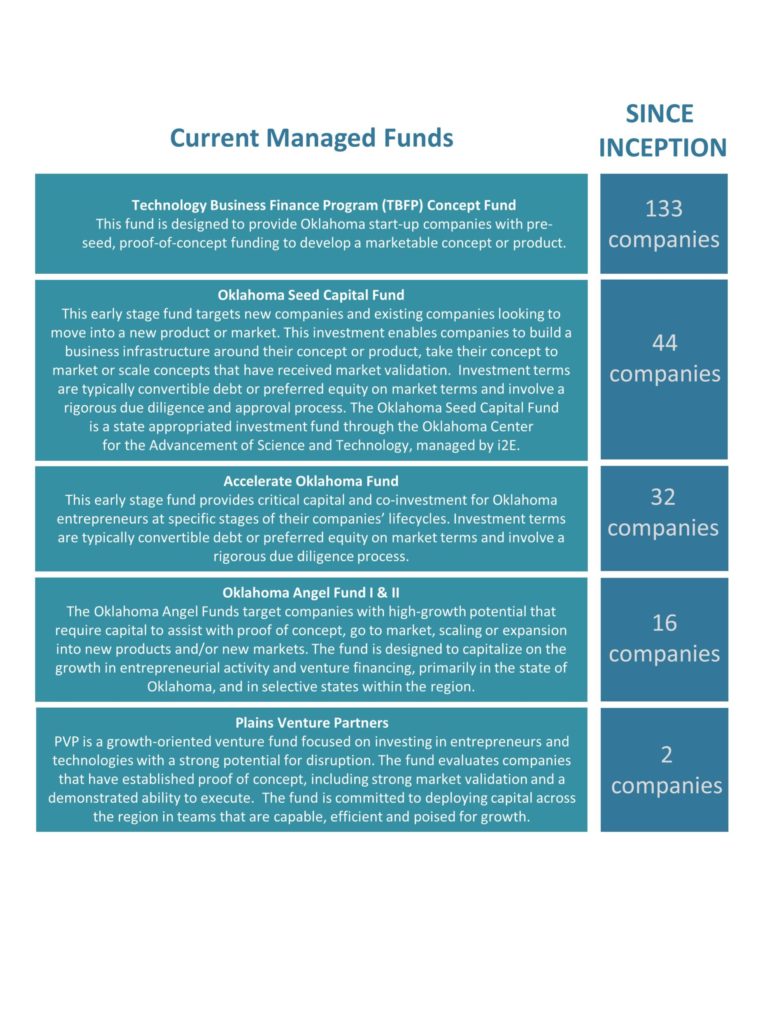

[/vc_column_text][vc_column_text] Since 1999, i2E has managed seven (7) early-stage investment funds, making 328 investments totaling over $76.5 million to 183 companies.

i2E also manages the SeedStep Angels, a network of Accredited Investors who provide capital, strategic advice and mentoring to emerging growth companies to help them succeed. Typical investments range from $50,000-$500,000 with individual members making investment decisions. Since the group’s inception in 2009, SeedStep Angels have invested in 56 companies.[/vc_column_text][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/6″][/vc_column][/vc_row]

[/vc_column_text][/vc_column][vc_column width=”1/6″][/vc_column][/vc_row]