| Remember Dave Berkus’ story about passing on an opportunity to invest in Amazon back in the early days? If not, I’ve attached that story from April’s update. It became a missed opportunity for hundreds of millions of dollars and a legendary return on investment multiple. Fortunately for Dave, he’s probably one of few that has been able to afford some of the opportunity cost due to his success as an angel investor which is why I use him as an example in this brief illustration. It got me thinking though… what things can an angel investor do to increase their odds of success? In short, 1) invest often and, 2) be aware of the potential requirements for success. “Ninety percent of the money I ever made as an Angel investor came from four investments… It’s the gambler’s mentality mitigated by the ability to select intelligently.” – Dave Berkus, 2014 New York Times article. To anyone new to angel investing, I think Dave would clarify that selecting intelligently includes making a fair amount of selections and not just a few “hopefuls”. For context, Dave participated in a panel discussion at the ACA Summit last spring as 1 of 4 investors who have made more than 100 investments (Dave’s total is more like 150+ if I remember correctly). Among those successful exits is GameSpy, a former provider of online multiplayer and matchmaking middleware for video games and, Green Dot, who grew to be the world’s largest pre-paid credit card company. Here are the profiles of those two investments: GameSpy

Green Dot

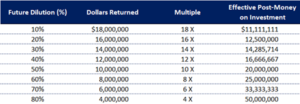

It’s interesting to note that both of Dave’s 2 best returns required tens of millions of additional capital through multiple rounds and 7 years on average to become an acquisition target. Will every investment mirror the same timeframe and capital requirements? No, but it’s interesting to see these themes emerge from successes by someone with the experience and knowledge that Dave possesses. We often emphasize and understand the need for making many investments but may not always emphasize post-initial investment requirements. More specifically, follow-on capital as it relates to dilution and considering those mechanics when deploying capital. Deployment: One repeated suggestion to consider from various angel investing material is applying something similar to a 25/75 rule. Too often have we seen investors invest $100 – $300K per company in 2 or 3 deals. Instead, some would suggest investing $25 – $50K per company in 10 or 20 deals. The more the better. This approach allows you to invest 25% of the total capital you plan to invest in a company upfront and then follow-on with the additional 75% into only the best deals you originally invested in. Essentially you are buying the right to information and the ability to track a company closely in anticipation of “doubling down” when prudent. Through this approach you can minimize your downside and take a more calculated approach to capture the upside. Clearly this overlooks specific scenarios where a company doesn’t anticipate needing to raise additional capital or some unique situation. Dilution: Let’s assume a seed investor invests $1 million in a company’s initial external capital raise at a $10 million post-money valuation. The company eventually sells for $200 million and it would be easy to infer that the seed investor made a 20x return on their money ($200/$10)… rarely the case which we all probably agree with and so, just how impactful can dilution be? The blog post I pulled this simplified example from goes on… Let’s say this theoretical company raises just one more round of financing. It’s a $10 million round at a $50 million post-money valuation. In addition, as part of the round, the option pool for the company is expanded by an additional 10%. After this round, the company has their $200 million exit. What originally started out as a 20x return on investment, actually ends up as a 14x return on investment given an additional 30% of dilution. Instead of receiving $20 million the investor receives $14 million which is a pretty significant difference even though both are decent returns but would become much more impactful as the acquisition value decreases. The blog post has interesting perspective of looking at the impact of dilution from that example in terms of an “effective post-money valuation”. Keep in mind the post-money valuation was $10 million on the original investment.

Another consideration that needs to be made is that each time an investor puts money into a follow-on round potentially preserving their ownership, they increase their cost basis and effective post-money valuation. In the previous example, let’s assume that instead of not participating in the additional round, the investor writes a check for $2 million. The result, · The investor bough 10% of the Seed round · The investor bought an additional 4% of the Series A round · $3 million in total investment · 30% dilution to the Seed dollars Final ownership is (10% x 70%) + 4% = 11%. In this example the investor would have invested more than their pro-rata share in a company they thought would be a winner. Then the company sells for $200 million. Is this investment a 10x for the seed investor who initially invested at a $10 million post-money valuation? No. The investor made 11% x $200 million or $22 million. They invested $3 million to get there and the result is a 7.3x return with an effective post-money valuation of $27 million. Good but not 10x thus showing the effects of dilution from follow-on capital. Additional considerations that could affect overall returns are things like company debt or any obligation by a company that would hold preference in distributions from a sale, warrants, or other outstanding convertible instruments. It’s important for investors to be aware of these items, if they exist, when determining what their potential return will be from a waterfall distribution because there’s a chance you could experience a similar dilutive effect. Whether a refresher or a 1st time illustration, hopefully this information will serve useful as you begin deploying capital into your own angel investment portfolio.

Link to New York Times article: https://www.nytimes.com/2014/05/03/your-money/angel-investors-need-a-high-risk-tolerance-not-billions.html Link to dilution blog article: https://bettereveryday.vc/how-hard-is-it-to-generate-a-10x-return-on-an-investment-9c1656d6c3af |